- Where We Work

- Interactive Map

- Afghanistan and Pakistan

- Africa

- African Union

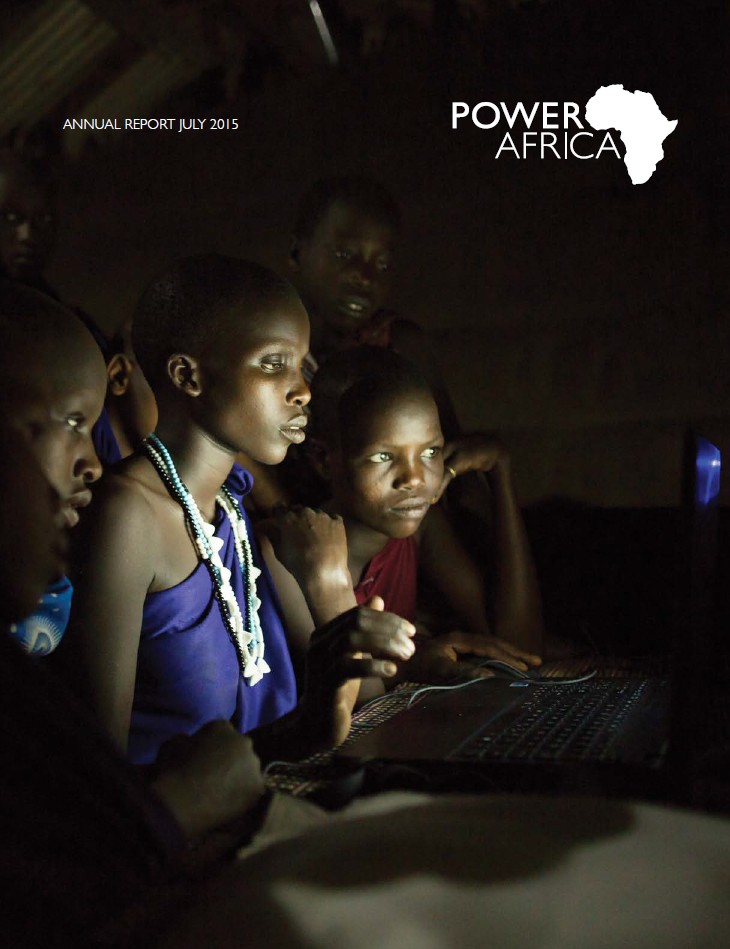

- Power Africa

- Trade and Investment Engagement

- Angola

- Benin

- Botswana

- Burkina Faso

- Burundi

- Cameroon

- Central Africa Regional

- Central African Republic

- Chad

- Côte d'Ivoire

- Democratic Republic of the Congo

- Djibouti

- East Africa Regional

- Ethiopia

- Ghana

- Guinea

- Kenya

- Lesotho

- Liberia

- Madagascar

- Malawi

- Mali

- Mauritania

- Mozambique

- Namibia

- Niger

- Nigeria

- Republic of the Congo

- Rwanda

- Sahel Regional

- Senegal

- Sierra Leone

- Somalia

- South Africa

- South Sudan

- Southern Africa Regional

- Sudan

- Swaziland

- Tanzania

- Uganda

- West Africa Regional

- Zambia

- Zimbabwe

- Asia

- Europe and Eurasia

- Latin America and the Caribbean

- Middle East

- Mission Directory

Power Africa’s Transaction Model

Power Africa employs a transaction-centered approach to directly address the constraints to project development and investment in sub-Saharan Africa’s energy sector. The model works with the private sector to build local capacity by supporting innovative ways to make traditional assistance programs more effective and sustainable.

Instead of taking years or even decades to create an enabling environment for energy sector investment, Power Africa’s transaction-centered approach focuses on facilitating more effective and efficient energy project transactions while simultaneously driving policy reform.

To provide transaction-centered support, Power Africa provides the following resources to advance these goals:

-

Interagency teams focused on transactions that serve as catalysts to bring power and transmission projects to fruition by leveraging financing, insurance, technical assistance, and grant tools from across the U.S. government and our private sector partners.

-

A team of field-based regional and country focused Transaction Advisors, professionals with experience in both the energy and investment sectors, work across sub-Saharan Africa to help governments prioritize, coordinate, and expedite the implementation of power projects. These transaction advisors work as impartial advisors to African partner governments and in direct coordination with officials from various U.S. Power Africa agencies in each country.

Reaching Financial Close

Reaching financial close, the final commitment of financing for a project by financiers, is a critical, difficult milestone that represents one of the best measures of Power Africa’s impact in the short term. Often the most difficult aspects of closing a power deal are securing the financing and finalizing the necessary agreements with a host government.

Repeatedly, private sector stakeholders point to the length of time for projects to reach financial close as a significant barrier to investment. There is an enormous opportunity cost - especially for developers who place their own equity and resources on the line -- to operating in an environment where financial close takes significantly longer than in alternative emerging markets. As such, Power Africa's interventions aim to ensure and accelerate financial close -- from facilitating the project’s bankability with financing and risk mitigation to providing technical and transaction support that ensures the project is planned and negotiated with best practices and developmental considerations.

A project reaches financial close only after the developer has demonstrated project feasibility and commercial and financial viability, including environmental and social assessments, land surveys, power purchase agreements, and government approvals and permits. Most of the significant project risks must be mitigated by the time a project reaches financial close or investors would not otherwise put their money into these deals.

Financial closure is just one milestone that Power Africa targets. In addition to meeting this major financial target, Power Africa is also partnering with governments to ensure that the regulatory environment is conducive for investments and that projects will have sound, sustainable development impacts.

Have more questions about Financial Close? Get answers in our Frequently Asked Questions section.

Beyond the Grid

Focused on rural electrification, small scale and off-grid technology programs, this sub-initiative of Power Africa, currently leverages over $1 billion in commitments from 40 founding private sector partners over five years. Visit the Beyond the Grid page.

Participate

Learn more about Power Africa’s innovative partnership model.

We welcome private sector partnership inquiries. Submit your contact information.

Comment

Make a general inquiry or suggest an improvement.