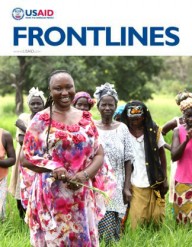

The mood was high as three village savings and loan (VSL) groups gathered in Zaloengera village, Malawi, for their end-of-year “share out,” the time of year each individual receives their earnings as a VSL shareholder. Group members were excited to be receiving their money—with interest.

Only three years ago, many of the VSL participants couldn’t dream of saving a few Kwacha, the official currency of Malawi, much less starting their own small business or expanding their crop production enough to sell to major buyers.

In 2009, that all changed when USAID/Malawi designed a development food assistance program implemented by a consortium led by Catholic Relief Services (CRS). The program tackles food insecurity through a variety of interventions, including VSLs, by challenging the notion that the poorest individuals can’t help themselves out of hunger and poverty. In a country where over 60 percent of the population lives on less than $1.25 a day and is affected by recurrent natural disasters as well as poor harvests, this was hard to imagine.

While not new to the international development community, the idea of a VSL group, and particularly the concept of saving, was foreign to the communities where CRS and its partners were working. Families in these villages typically had barely enough to scrape by, and often felt obligated to give any savings to a relative or neighbor in need. In addition, those families able to borrow from money lenders had to do so at interest rates as high as 50 percent in some cases.

Many communities were skeptical of the VSL at first. How could they save money when they hardly had any to begin with?

The VSL caters to those who don’t have many resources. By putting in a small amount, even pennies, weekly or biweekly into the group’s savings box, the accumulated savings and interest over the course of a year adds up.

“Often in rural villages in Malawi, community members feel they must give any extra savings to a relative or neighbor in need to help pay for a funeral, for school fees, etcetera. The VSL program provides our beneficiaries with a socially acceptable venue through which to save money that cannot be easily accessed when a relative or neighbor comes by to borrow money,” said Bahati Kalera with Project Concern International, a consortium partner.

In 2013, the 51 members of three VSL groups in Zaloengera village managed to save 1.1 million Kwacha, about $2,650, for an average of $52 per person. For families who had never saved before, this helped them move beyond living day to day, and begin to invest in their futures.

Lines Katchile, 31, is now taking control of her family’s future through a VSL group. Katchile, who lives in Jumbe village, is married with five children. She had no savings prior to joining her VSL group, and was considered to be one of the poorest in her community. Her farmer husband owns a small fish-selling business, but even his income combined with hers from casual labor was not enough to consistently feed the family and provide a steady source of income.

In 2012, Katchile took some of her family’s limited earnings and invested it in a VSL group after hearing from others of its benefits. During her first six months in the VSL group, she saved about 25,000 Kwacha, or $60. These initial earnings were enough to buy iron sheets to roof her house and a few other household items. During 2013, she saved 75,000 Kwacha, or $180. How did she do it?

In the VSL model, clusters of 15 to 20 marginalized women and men form themselves into groups and make regular saving deposits into a communal village bank, with no external resources or capital provided. The collective money is loaned out to VSL members on an individual basis, allowing participants to use the lump sums as capital to invest in small business enterprises, buy seeds or purchase food and other household needs. The loans are then paid back to the group at an agreed upon interest rate, thereby allowing members to earn interest on their savings. VSLs are just one intervention among many in this CRS program, with an aim to address food insecurity holistically, not just with food.

As a contributing member to her VSL, Katchile received two loans over the last year and a half. Her first loan covered the cost of two goats for a new breeding business. Her second loan enabled her to purchase two more goats. After breeding resulted in two kids, Katchile has enough goats to keep at least one pair for breeding and sell the others for income.

“One of the most important things I gained is time management, because I do not have to do casual labor,” said Katchile. In fact, her VSL savings allowed her to develop three new sources of income: a small sugar cane business, a small liquor brewing business, and her goat breeding business. She believes the businesses will provide her a steady income as she continues to grow them, allowing her to better provide for her family.

VSL groups have taken off in Malawi as they help people build a better life for themselves and their families. While the consortium initially designed the VSL groups only for USAID program beneficiaries, in 2011, it began allowing non-beneficiaries in the communities to join. Today, as much as 15 percent of VSL members are estimated to be not directly affiliated with the program.

Across all VSL groups started by consortium partners, members have saved a cumulative total of $1.6 million since 2010, growing from the initial 696 groups to 7,400 groups today. That’s more than 92,710 Malawians—65,470 women and 27,240 men—saving on a regular basis. Katchile is just one of the many vulnerable women the VSLs have empowered to better provide food and care to their families.

As a VSL group becomes more closely knit, each of its members grows more invested in its growth and success, meaning they then can help each other to ensure every loan repayment is made. CRS and its partners are also working to ensure these groups will continue past June 2014 when their program closes. Members are encouraged to take advantage of the group economies of scale to expand their individual income-generating activities.

Comment

Make a general inquiry or suggest an improvement.