- What We Do

- Agriculture and Food Security

- Democracy, Human Rights and Governance

- Economic Growth and Trade

- Education

- Ending Extreme Poverty

- Environment and Global Climate Change

- Gender Equality and Women's Empowerment

- Global Health

- Water and Sanitation

- Working in Crises and Conflict

- U.S. Global Development Lab

-

Learn More

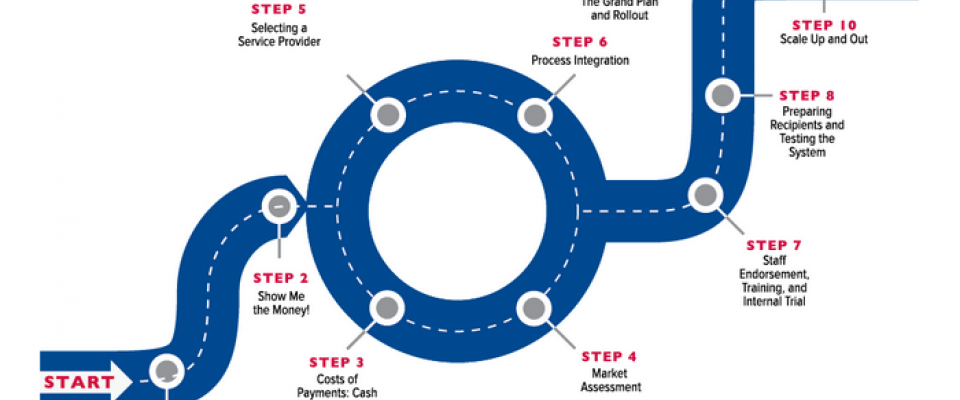

Digital Finance for Development: A Handbook for USAID Staff

-

Learn More

Read the Beyond Cash report for insights on digital payments usage and acceptance in India

-

Learn More

Check out the Electronic Payments Toolkit

Digital finance represents a new approach to financial inclusion: it gives poor families access to an array of affordable financial tools and services that make financial transactions cheaper, more secure and transparent, and helps them weather severe financial shocks and lead more resilient lives.

And it helps build lasting, inclusive economic infrastructure that improves governance, creates transparency, reduces theft and graft, and provides a foundation for innovative, new business models to offer life-enhancing services, such as off-grid solar power, to underserved communities.

Yet for all the promise these systems offer, in most countries they are not organically growing at the rate needed in order to meet our ambitious targets for poverty alleviation globally.

The Lab's Digital Finance team acts on the digital opportunity to create inclusive, pro-poor financial sectors that serve the needs of governments, underserved populations, and industry, thereby helping the world’s financially excluded populations access and use financial services that meet their needs.

Better than Cash Alliance

In 2012, USAID partnered with the United Nations Capital Development Fund, the Bill and Melinda Gates Foundation, Citi, the Ford Foundation, Omidyar Network, Visa, and MasterCard to catalyze a global movement to shift from cash to digital payments. By April 2016, 50 members had joined the Better than Cash Alliance and committed to digitizing their payments. Those include 20 governments, 20 international organizations, including UNDP and the World Food Programme, as well as the Coca-Cola Company and Grupo Bimbo, the world’s largest baking company. One BTCA member, Mexico, is saving an estimated US $1.3 billion per year (or 3.3 percent of total government payments) by centralizing and digitizing its payments, while Colombia is now conducting 65 percent of government transactions in digital form. Further, assisted by the Alliance’s catalytic funding and technical support, Peru’s private sector launched the world's first mobile payment system to be built from scratch in 2015.

U.S.-India Partnership

Recognizing the critical role digital payments can play in deepening financial inclusion, the Government of India’s Ministry of Finance and USAID launched a Partnership in 2015 specifically focused on increasing the use of digital payments at point of sale, particularly among small and medium enterprises and low-income consumers. Over 35 key Indian, American, and international organizations and businesses have partnered on this initiative. To help guide the Partnership’s work, USAID recently conducted research and released a report, Beyond Cash, to understand the behaviors and preferences of Indian consumers and merchants, particularly those whose needs for relevant, accessible and affordable financial services have not been adequately met.

In October 2016, USAID announced the launch of Catalyst: Inclusive Cashless Payment Partnership (www.cashlesscatalyst.org), which marks the next phase of the partnership. Housed within the Institute for Financial Management and Research (IFMR), Catalyst will combine new technology, business models, and institutional innovations to help merchants and consumers, in particular low-income and disadvantaged populations, participate in India’s growing digital economy.

Comment

Make a general inquiry or suggest an improvement.