Jalal Molla with his solar lights and sewing machine

Souradeep Ghosh, Arc Finance

Jalal Molla with his solar lights and sewing machine

Souradeep Ghosh, Arc Finance

Jalal Molla with his solar lights and sewing machine

Souradeep Ghosh, Arc Finance

Jalal Molla with his solar lights and sewing machine

Souradeep Ghosh, Arc Finance

Activities average Americans may take for granted—flipping a switch to flood a room with light, boiling water by turning the dial on a stove, or charging a cell phone overnight while they sleep—simply aren’t possible in many parts of Africa and Asia. Worldwide, more than 1.4 billion people lack access to electricity, and 2.8 billion lack access to modern cooking fuels and devices.

This not only holds them back economically, it can be dangerous. According to the World Health Organization, more than 95 percent of deaths from fire and household burns occur in the developing world. In southern India, for example, burns are the number two cause of childhood injuries or mortalities, with about half due to kerosene lamps. In Uganda, one study found 70 percent of house fires were caused by kerosene lanterns.

Since many people relying on traditional sources of energy earn only a few dollars per day, obtaining the money needed to pay for electricity or buy modern energy devices is a formidable barrier. USAID is working to address this challenge in Uganda, India and Haiti via its four-year, $5.6 million Renewable Energy Microfinance and Microenterprise Program (REMMP).

REMMP expands the availability of consumer financing for clean energy products, helping low-income people buy devices that improve their incomes and quality of life, and reduce carbon emissions at the same time. Companies that finance or sell small renewable energy devices, such as solar lanterns and clean cookstoves, are supported through REMMP and its implementing partner Arc Finance.

“Assuring that firms selling such products are financially sound is vital to ensure a sustainable supply of goods and enable the firms to foster even more innovations,” says Kevin Brownawell, director of the Office of Energy and Infrastructure at USAID.

Arc currently is working with 13 different organizations to develop and test business models that will make it easier for tens of thousands of poor people to purchase clean energy products. Among the models being explored are traditional financing methods such as microfinance, as well as new applications such as crowd funding and remittances.

Pioneering Off-Grid Solar in Uganda

REMMP partner SolarNow is a private business that sells solar home systems in Uganda, where less than 5 percent of the rural population have access to electricity. The solar systems can light several rooms and power critical household items such as cell phones, radios and TVs. However, at a cost of $475 to $1,400 per system, they can seem out of reach to ordinary rural residents of Uganda, where the average per capita annual income is $440.

To overcome this price barrier, SolarNow created its own in-house “pay plan.” Customers pay over a 12-month period until they have covered the full price of the system, at which point ownership is transferred to them and they receive a two-year service warranty. Because most customers stop using other forms of lighting when they buy a solar system, they can use funds they previously used to buy kerosene toward their monthly payment.

Francis Kilate, who lives in a small, dusty village near Kamuli in Uganda, is a SolarNow customer. After purchasing his SolarNow system on credit in October 2012, he began charging cell phones in his house at a cost of $.20 per charge. Kilate recovered the cost of his system within six months, and now is generating additional revenue for his family.

“Due to my phone-charging solar system, I have become one of the main business persons in my area. I now want to expand my solar system to power a computer and offer access to the Internet,” he says.

The head teacher of Bugabula Secondary School, Ngobi Joshwa, decided to invest in a small solar system with six lights for the school, allocating scarce resources from students’ school fees for the purchase.

“I am really happy that our pupils can now continue studying after sunset, which has increased exam results by 8 percent compared to last year. Parents welcome the development and have asked whether the kerosene lamps in the dormitories can be replaced. We plan to upgrade our system next term to answer their demands.”

Arc Finance has been working with SolarNow to improve its operations and expand its pay plan, which is used by the majority of its customers. Since it began operations two years ago, SolarNow has grown rapidly, installing over 3,000 systems through 35 branches, and creating 126 jobs.

Jerry Awori Bugiri, a SolarNow branch manager, says: “My clients are very happy with the solutions we offer. Without the credit, most would not be able to afford good solar systems. My business is growing as more people hear about the good quality and the 24 months free maintenance.”

Thanks to a $2.5 million loan guarantee from USAID’s Development Credit Authority (DCA), SolarNow obtained financing from Centenary Rural Development Bank, a Ugandan bank new to the energy sector. SolarNow Managing Director Willem Nolens thinks the guarantee played a critical role in enabling the company to reduce costs while simultaneously expanding its business.

“The guarantee we received from USAID enabled us to get a local bank loan and attract new investors. It will help us create access to energy for an estimated 120,000 people over the coming five years. We could not have done this without the support of USAID,” says Nolens.

Crowd-Funding a Clean Tech Revolution in Rural India

In 2000, Animesh Naiya, the managing director of Dhosa Chandaneswar Bratyajana Samity (DCBS), was unemployed. He tried various things to get work, from poultry farming to goat farming, but because he didn’t have any collateral, he was unable to get a bank loan to start a business.

After reading about an organization that gave credit to people for income generation, he decided to start his own organization that would do the same thing. He persuaded his father to let him use an empty family apartment as an office, and raised money from his immediate family, relatives and other shopkeepers to start the business. The organization officially opened its offices in December 2003 with 300 members.

Today, DCBS is a small community-based microfinance institution (MFI) that operates in roughly 200 village communities in West Bengal’s South 24 Parganas district. Ten years after its founding, the organization maintains a client base of more than 10,000 women, most of whom are saree embroiderers or engaged in small-scale agriculture. The focus on women reflects Naiya’s belief that women are more reliable customers, almost always repaying their loans.

Microfinance institutions serve large numbers of poor clients who otherwise are excluded from financial services in India and elsewhere. Commercial banks in many parts of the world are reluctant to lend to small borrowers who possess little collateral because they do not have the human or physical infrastructure in place to serve remote, low-income rural markets the banks perceive as risky and costly to serve.

The Indian microfinance sector alone reached over 26 million active borrowers in 2012, and thousands of self-help group networks and federations claim over 60 million members. Access to credit allows poor households to make investments that generate additional income and/or improve their quality of life. Access to affordable credit can also increase economic security by smoothing inconsistencies in income in the short term.

Naiya’s organization grew rapidly until 2010, when India faced a microfinance crisis and funding for small organizations like DCBS dried up.

“After the crisis, no banks or NGOs were willing to give us any funds. We really thought we would have to close down. Then we met Milaap and Arc Finance,” says Naiya.

Arc is partnering with Milaap, an investment platform for MFIs, to establish a low-cost revolving credit facility for MFIs engaged in energy lending. Milaap raises funds by “crowd sourcing” online, primarily from the Indian diaspora, and USAID matches the funds in the form of a grant from Arc. Milaap then lends the money to qualifying MFIs at rates lower than those offered by commercial banks.

The goal behind the revolving fund is to stimulate MFI interest in the sector and reduce borrowing costs of MFI customers. Arc is also providing technical assistance to Milaap’s MFI sub-partners to help them finance a range of energy services including solar, clean cookstoves and microgrids.

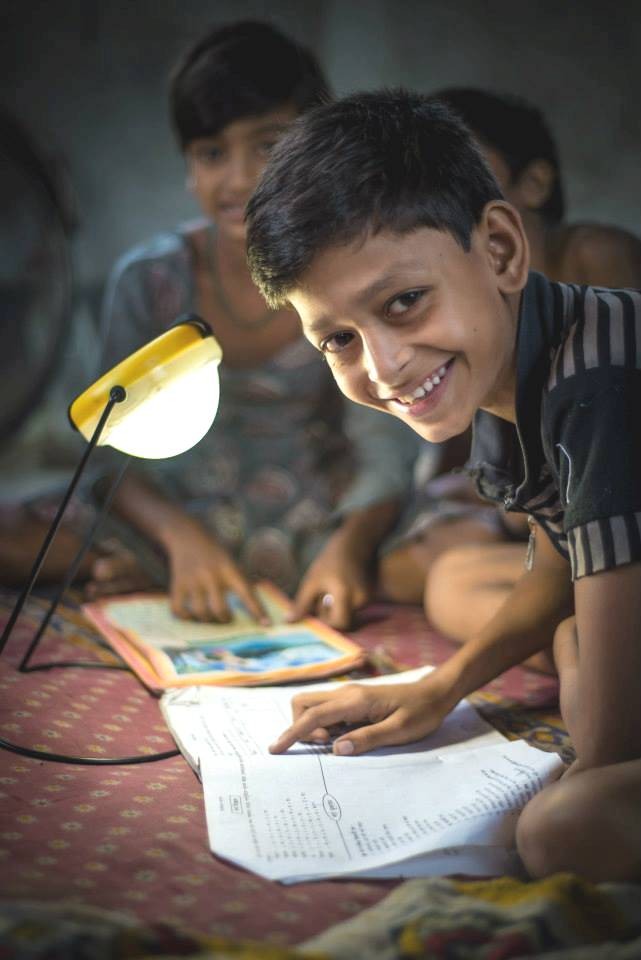

In December 2012, with a line of credit from Milaap and technical assistance from Arc, DCBS began promoting a solar lantern loan product to existing borrowers, based on its own analysis of its clients’ needs. A significant percentage of active borrowers are grid-connected, but service is very limited and highly irregular, with frequent, extended outages lasting several hours a day. Kerosene and candles are widely used as backup sources, but poor light quality and indoor air pollution make these alternatives unattractive.

DCBS staff began demonstrating a small portable solar charging device that produces a clear, smoke-free light 10 times brighter than the common kerosene wick lamp used by virtually all DCBS clients. Moreover, the lantern can also charge mobile phones and is much safer than the traditional glass lamps that can tip or break easily and cause fires. Borrowers may purchase the product on credit directly from the bank with a low-cost, 12-month loan.

Asma Molla, who is an embroiderer, a DCBS client and a solar lantern owner, explains: “After my husband Jalal and I bought the solar light, we began to make more money. We used to make Rs 5,000 per month [around $82]. Now, sometimes we earn as much as Rs 2,500 a month more, which is 50 percent more than our previous income. It has made a big difference to us as we have five boys to feed. The boys are full of life and energy, and it used to make me so worried if I left them alone together to study or to play with only the kerosene lamp for light. Now I can relax … the solar light won’t cause a fire and it is very strong. Even if it falls on the floor, it won’t break.”

Growing word-of-mouth communication between members has begun to yield dramatic results. In the month of July alone, DCBS approved 369 new loan applications—nearly the same amount for the entire previous six months combined. Sales skyrocketed after the Diwali “festival of lights” holiday in October, bringing the total to more than 1,600 lights sold by the end of 2013. DCBS hopes to increase total sales to 3,000 by the end of 2014.

Going to Scale

Most renewable energy firms in the developing world remain small due to lack of end-user finance and challenges with distribution. REMMP is built on the premise that businesses that grow successfully share important attributes: an understanding of the interrelationship between finance, distribution and technology; an approach tailored to local markets; and the leveraging of existing financing and distribution channels for easier and quicker growth. All REMMP activities incorporate these elements to ensure the program achieves its objectives, and lessons learned are shared with others in the sector to multiply impact.

In the coming year, REMMP plans to work with some of the world’s largest global money transfer organizations and MFIs to further test different forms of consumer finance and bring the benefits of renewable energy to more consumers. The goal is to reach 500,000 people by the end of the project.

Eric Postel, assistant administrator of USAID’s Bureau for Economic Growth, Education and Environment, adds, “Programs that focus on bringing cleaner energy to impoverished communities not only transform lives, but can accelerate development progress in regions with great challenges. They are a critical element in our effort to end extreme poverty by 2030.”

Nicola Armacost is with Arc Finance.

Comment

Make a general inquiry or suggest an improvement.