July 2014—Jessie Lebanan, Elizabeth Entienza, and Emerlita Balasbas are clearing a path for Filipino micro-entrepreneurs and cooperatives to better manage their money and receive loan proceeds through a new, unconventional method.

With high transportation costs and long travel times, many Filipinos lack access to financial services. As a result, they miss opportunities to manage and grow their money. So USAID has engaged local governments, businesses and financial institutions to deliver banking services via the one tool that nearly all Filipinos possess—their mobile phones.

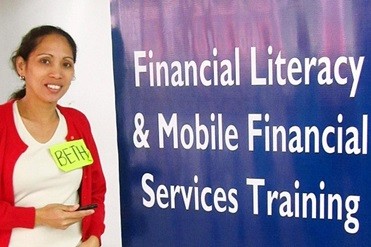

USAID’s Scaling Innovations in Mobile Money Project allows mobile phone users to pay taxes, loans and other bills through their personal phones. The program also teaches the basics of money management to consumers, cooperatives and entrepreneurs. Ninety community leaders were trained from late 2013 to early 2014 to teach their peers how to save, borrow and invest money. The program operates in Quezon City, Valenzuela City, Batangas City, and Pulilan, Bulacan, with Iloilo City and Cagayan de Oro City soon to be launched. The program is also working with some of the country’s biggest microfinance institutions such as the National Confederation of Cooperatives, First Isabela Cooperative Bank, and the CCT Savings and Credit Cooperative.

“Many participants don’t know how to handle their own finances and are afraid to take risks, making it a challenge to introduce this technology,” says Lebanan, 29. He has been a money management trainer for more than eight years and mobile money is new even to him. “I just started using it myself,” he says. “I get rebates for selling airtime load. On a cab ride home, I can pay my electricity bill.” It seems that even the trainers are benefiting from the program.

“Acquiring capital is difficult for micro-entrepreneurs,” says Entienza, 36. Mobile money, she explains, is potentially a safer way to release loans.

Another trainer, Emerlita Balasbas, 52, travels across the country teaching mothers how to start their own food business, like cooking and selling rice cakes or creating crafts out of recycled material. “With mobile money, we can reach even more people, in cheaper, safer and more effective ways,” she says.

By educating consumers and business owners on financial literacy, trainers like Lebanan, Entienza and Balasbas are providing Filipinos across the country the opportunity to maximize their potential and participate in USAID/Philippines’ vision of sustained inclusive growth.

The Scaling Innovations in Mobile Money Project runs from April 2012 to August 2014.

Links

Follow @USAID_Manila, on Facebook, on Flickr, on YouTube

Comment

Make a general inquiry or suggest an improvement.