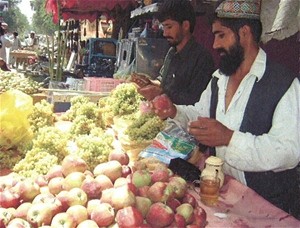

Sayed Mahmmad and his brother prepare their produce for sale.

USAID/WOCCU

USAID supports Islamic credit unions to provide financial services to rural communities.

8 FEBRUARY 2010 | LAGHMAN PROVINCE, AFGHANISTAN

Over the past 18 months, Sayed Mohammad, a fruit merchant from Gomen village in Laghman province, has transformed his business from a small, one-man fruit cart into a large fruit and juice stall with employees, and has become the primary supplier of watermelons to cart vendors in the area. This expansion was made possible when Sayed Mohammad became a member of a Sharia-compliant, USAID-supported credit union.

In Afghanistan, the lack of access to financial services is a significant hindrance to economic growth and development, especially among small and medium businesses. Providing these services in a manner consistent with Islamic law (Sharia), which forbids the payment or earning of interest on loans, is important. In response to this need, USAID and the World Council of Credit Unions (WOCCU) are establishing a network of credit unions, known as Islamic Investment and Finance Cooperatives (IIFCs), whose management and products are Sharia-compliant.

Sayed Mohammad had been trying to expand his business to meet growing demand, but lacked access to a source of capital. In July 2009 – 10 months after joining the Laghman IIFC – he received a Sharia-compliant “financial advance” (SCF) of 25,000 Afghanis ($500), which he used to rent a better location for his cart. His monthly income increased from 7,500 to 20,000 Afghanis ($150 to $400), enabling him to meet his monthly payments on time. A second SCF allowed him to purchase a cane juice machine and hire his brother to work with him. Sayed Mohammad plans to apply for a third SCF to expand his business to other districts and to hire more employees. He is pleased with his successes, and expressed his gratitude to the Laghman IIFC for trusting him and making the expansions possible.

After five years of development, 16 member-owned IIFCs are currently bringing financial services to approximately 47,000 members across Afghanistan. USAID and WOCCU will continue to expand the network of IIFCs, working with tribal and religious leaders to bring financial services and economic stability to hard-to-reach communities throughout the country.

Comment

Make a general inquiry or suggest an improvement.