For Immediate Release

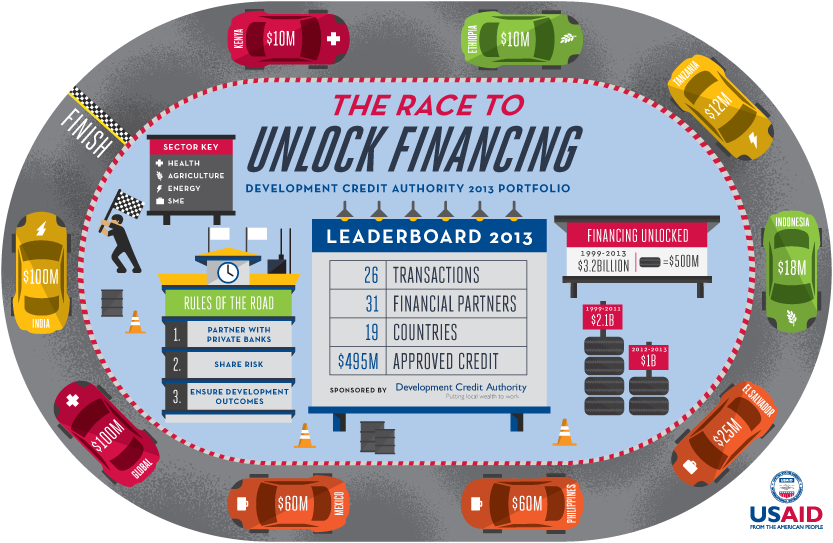

WASHINGTON, DC- USAID’s Development Credit Authority (DCA), a pioneering guarantor in the development finance arena, catalyzed $1 billion of private capital for businesses across the developing world over the past two years. The surge in local financing mobilized reflects USAID’s commitment to leverage private capital for development.

“Recognizing that the private sector is critical to the success of our development efforts, I asked our missions to prioritize mechanisms like the Development Credit Authority so we can leverage more private capital for development,” said USAID Administrator Rajiv Shah. “It took us 11 years to open the first $2 billion under DCA, and only two years to reach the next billion. That reflects a fundamental difference in the way we’re working.”

USAID is increasingly working with banks in developing countries to unlock private capital to prove the creditworthiness of underserved entrepreneurs at little to no cost to American taxpayers. With historically low default rates, USAID has paid out only $10.8 million in claims across the entire portfolio while collecting the same amount in bank fees.

Since its creation in 1999, DCA has made available more than $3.1 billion in private capital. In the past year alone, DCA unlocked $500 million for businesses in developing countries.

“We’re working hard to push the limits of development finance,” said Ben Hubbard, Director of USAID’s Development Credit Authority. “Finding novel private capital solutions to traditional development problems is changing the way development is done.”

Highlights from DCA’s FY13 portfolio include:

- A five-year, $100 million partial guarantee will accelerate the procurement of essential medicines and health supplies by governments and civil society partners through the Pledge Guarantee for Health.

- A partnership with U.S.-based institutional investors will facilitate a $100 million investment in India’s clean energy sector via Nereus Capital. This investment is expected to create hundreds of additional megawatts of sustainable energy capacity and will help to advance India’s burgeoning clean energy industry.

- The creation of the Agriculture Fast Track, a $25 million dollar first-of-its-kind fund that will spur greater private investment in agriculture infrastructure projects in Sub-Saharan Africa.

A full listing of USAID’s FY13 guarantees can be accessed at www.usaid.gov/dca.

Comment

Make a general inquiry or suggest an improvement.