Home » IPN 1 - Goods and Services Tax Guidelines

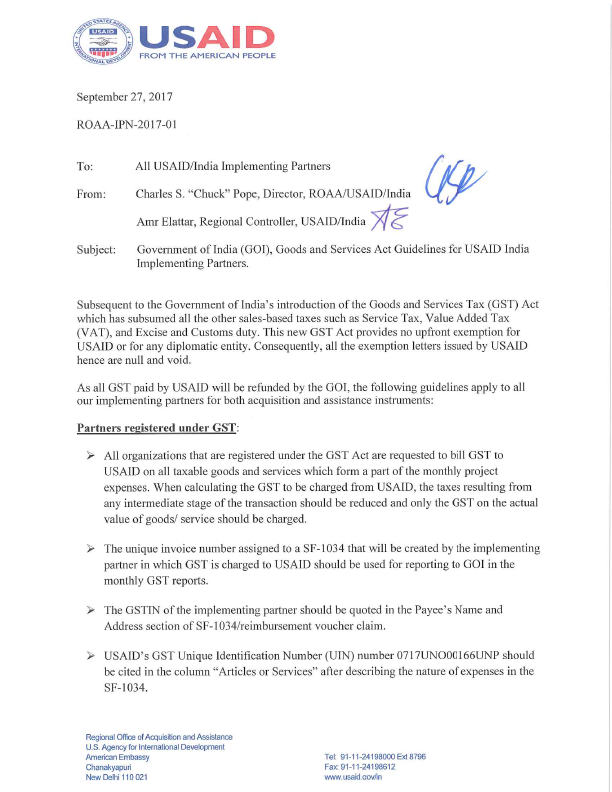

September 27, 2017 ROAA-IPN-2017-01

To: All USAID/India Implementing Partners

From: Charles S. "Chuck" Pope, Director, ROAA/USAID/India

Amr Elattar, Regional Controller, USATD/India Subject: Government of India (GOI), Goods and Services Act Guidelines for USAID India Implementing Partners.

Subsequent to the Government of India's introduction of the Goods and Services Tax (GST) Act which has subsumed all the other sales-based taxes such as Service Tax, Value Added Tax (VAT), and Excise and Customs duty. This new GST Act provides no upfront exemption for USAID or for any diplomatic entity. Consequently, all the exemption letters issued by USAlD hence are null and void.

Issuing Country

Date

Friday, October 6, 2017 - 12:45am

Comment

Make a general inquiry or suggest an improvement.