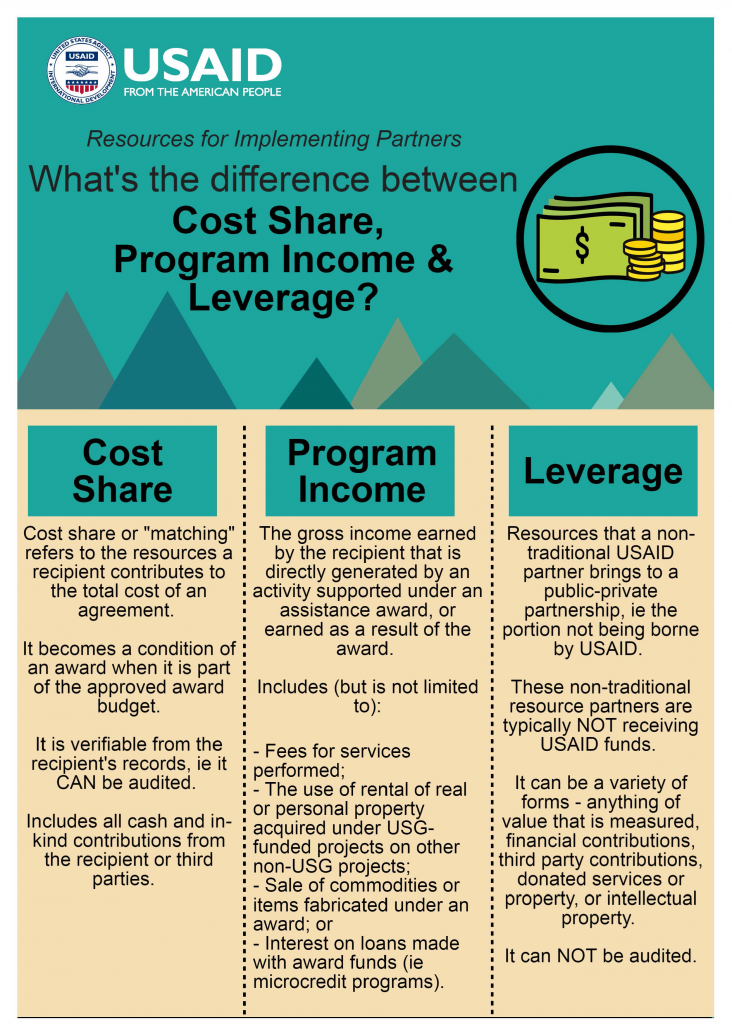

Resources for Implementing Partners

What’s the difference between Cost Share, Program Income and Leverage?

Cost Share

Cost share or "matching" refers to the resources a recipient contributes to the total cost of an agreement. It becomes a condition of an award when it is part of the approved award budget. It is verifiable from the recipient's records, ie it CAN be audited. Includes all cash and in-kind contributions from the recipient or third parties.

Program Income

The gross income earned by the recipient that is directly generated by an activity supported under an assistance award, or earned as a result of the award. Includes (but is not limited to):

- Fees for services performed;

- The use of rental of real or personal property acquired under USG-funded projects on other non-USG projects;

- Sale of commodities or items fabricated under an award; or

- Interest on loans made with award funds (ie microcredit programs).

Leverage

Resources that a non-traditional USAID partner brings to a public-private partnership, ie the portion not being borne by USAID. These non-traditional resource partners are typically NOT receiving USAID funds. It can be a variety of forms - anything of value that is measured, financial contributions, third party contributions, donated services or property, or intellectual property. It can NOT be audited.

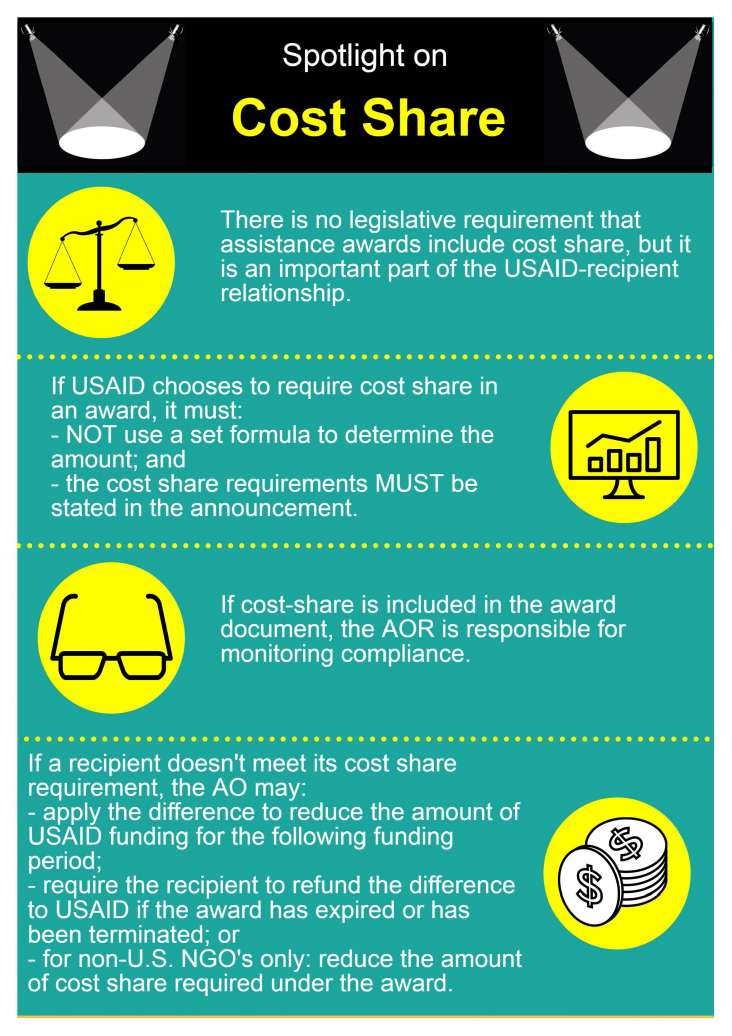

Spotlight on Cost Share

There is no legislative requirement that assistance awards include cost share, but it is an important part of the USAID-recipient relationship.

If USAID chooses to require cost share in an award, it must:

- NOT use a set formula to determine the amount; and

- the cost share requirements MUST be stated in the announcement.

If cost-share is included in the award document, the AOR is responsible for monitoring compliance.

If a recipient doesn't meet its cost share requirement, the AO may:

- apply the difference to reduce the amount of USAID funding for the following funding period;

- require the recipient to refund the difference to USAID if the award has expired or has been terminated; or

- for non-U.S. NGO's only: reduce the amount of cost share required under the award.

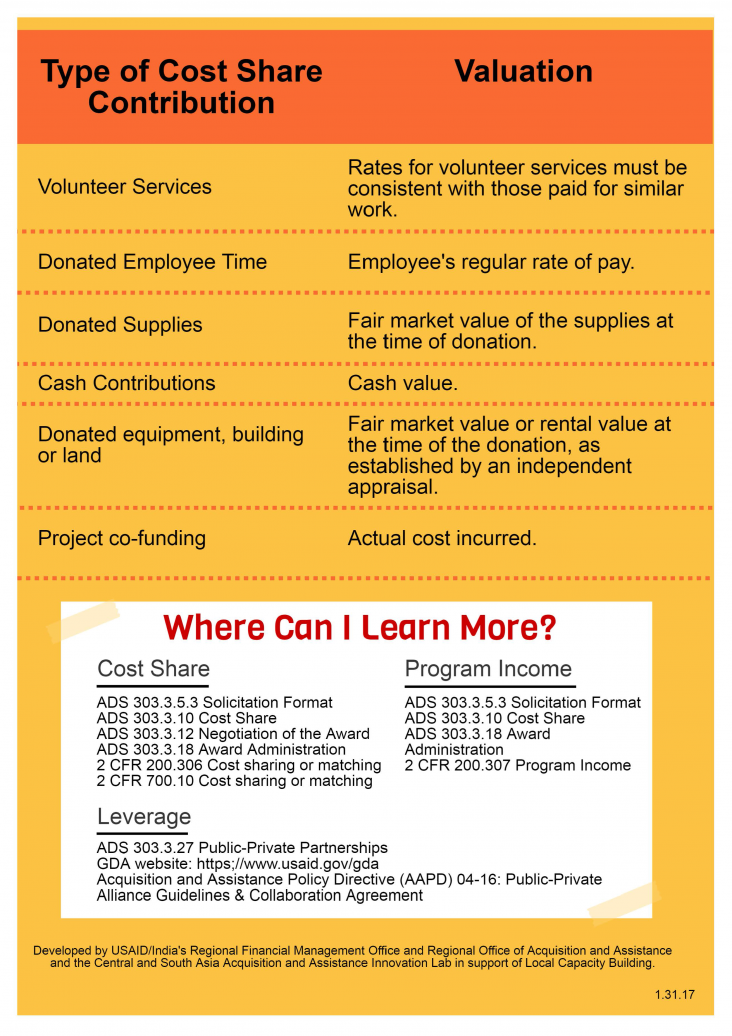

| Type of Cost Share Contribution | Valuation |

|---|---|

| Volunteer Services | Rates for volunteer services must be consistent with those paid for similar work. |

| Donated Employee | Time Employee’s regular rate of pay. |

| Donated Supplies | Fair market value of the supplies at the time of donation |

| Cash Contributions | Cash value. |

| Donated equipment, building or land | Fair market value or rental value at the time of the donation, as established by an independent appraisal. |

| Project co-funding | Actual cost incurred |

Where Can I Learn More?

Cost Share

- ADS 303.3.10 Cost Share

- ADS 303.3.12 Negotiation of the Award

- ADS 303.3.18 Award Administration

- 2 CFR 200.306 Cost sharing or matching

- 2 CFR 700.10 Cost sharing or matching

Program Income

- ADS 303.3.5.3 Solicitation Format

- ADS 303.3.10 Cost Share

- ADS 303.3.18 Award Administration

- 2 CFR 200.307 Program Income

Leverage

- ADS 303.3.27 Public-Private Partnerships

- GDA website: https;//www.usaid.gov/gda

- Acquisition and Assistance Policy Directive (AAPD) 04-16: Public-Private Alliance Guidelines & Collaboration Agreement

Developed by USAID/India’s Regional Financial Management Office and Regional Office of Acquisition and Assistance and the Central and South Asia Acquisition and Assistance Innovation Lab in support of Local Capacity Building.

Comment

Make a general inquiry or suggest an improvement.