Transition to private concession improves service quality, drives changes in customer behavior.

The Government of Uganda granted a concession for the supply of electricity from the Uganda Electricity Distribution Company Limited (UEDCL) to Umeme Limited to repair, upgrade and expand Uganda’s Distribution System. A consortium of investors, led by Globaleq and Eskom, secured the concession in March 2005. After an internal restructuring of the consortium, Actis Capital acquired full ownership of Umeme in 2006.

The twenty year concession allows for the lease of UEDCL’s network. Umeme maintains and operates the network, collects revenues from customers based on the tariff set by the Electric Regulatory Authority (ERA), in accordance with the licenses and the privatization agreement. Under the contract, Umeme agreed to make investments in upgrading, expanding, and maintaining the distribution network assets, and to return control of the distribution assets, including new investments, to UEDCL at the end of the concession. The concession is structured so that Umeme receives an annual 20 percent return on fixed assets and working capital. The company receives all of the reward and bears all the risk of achieving its tariff targets, including distribution losses, uncollected debt, and Distribution Operation, and Maintenance Costs (DOMC). Umeme is incentivized to meet or exceed its sales volume and tariff targets because it directly benefits from the additional revenues from growth in sales, after payment of its power supply and operating costs. The World Bank provided $10 million in assistance for distribution expansion and rehabilitation equipment and materials.

Umeme is an example of how privatization can provide a struggling utility with the necessary incentives and resources to improve current services and expand programs to better serve its customer base. Since inception, Umeme has made capital investments in service provision a top priority, by expanding distribution assets and improving offerings. The utility has invested in mobile payment and pre-payment systems, specifically tailored to customer needs. Umeme has also built its reputation by transparently disclosing safety and load shedding statistics. These efforts to engage and tailor services to customer needs built Umeme’s reputation as a service worth paying for, fundamentally changing the way customers were willing to interact with the utility.

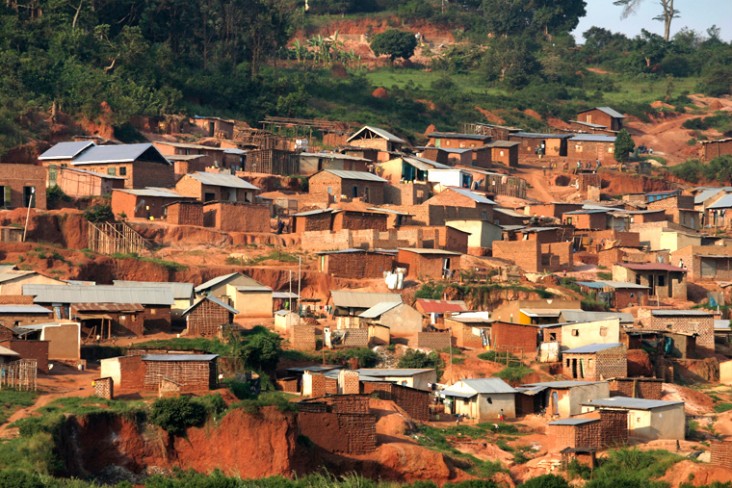

To date, Umeme has increased customers by 284,000, increased electricity sales by 1.1 GW, increased revenue collection rate to 100 percent, and reduced total energy losses from 38 percent to 24 percent. The consortium has invested $224 million in the distribution network, focusing on constructing new lines and substations, creating new metered customer connections, and repairing infrastructure to reduce technical losses. Umeme went public in 2012, offering 40 percent of its holding through an initial public offering (IPO) and listing on the Uganda Securities Exchange (USE) and a cross listing on the Nairobi Securities Exchange (NSE). The company used the proceeds to continue investments in the distribution network.

Comment

Make a general inquiry or suggest an improvement.