Ethiopia is blessed with approximately 107,600 square kilometers of arable land (about 11 percent of its territory); yet, it has struggled for many years to feed its people. Government policies have wreaked havoc among Ethiopia’s farmers with drastically changing land use rights.

One problem Ethiopia’s farmers face is lack of access to finance, which they need to modernize their practices and purchase machinery. As of June 2000, most lending to the agriculture sector was still from the state-owned Commercial Bank of Ethiopian (CBE) and the Development Bank of Ethiopian (DBE), which provided 99 percent of the banking sector’s outstanding agriculture loan value at the time. Even so, agricultural lending made up only 8 percent of the total value of outstanding loans.

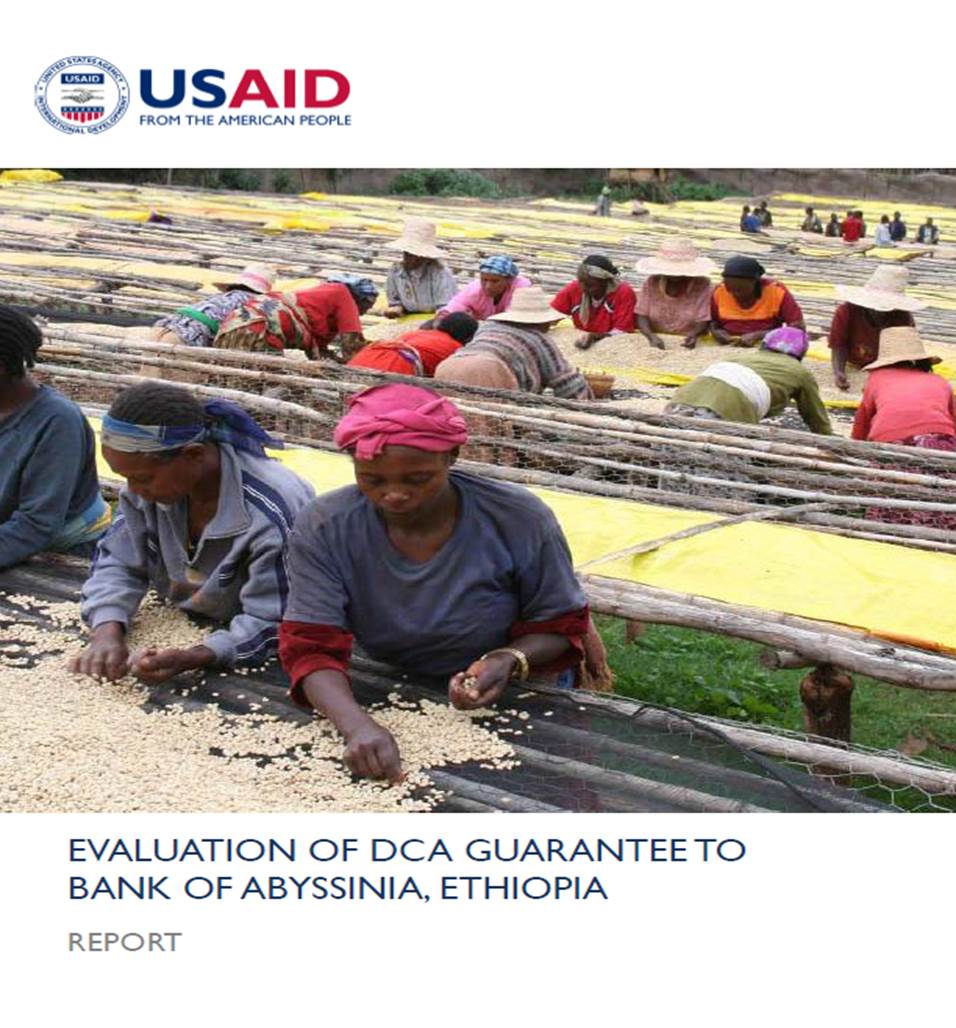

USAID’s Bureau of Economic Growth, Agriculture and Trade / Office of Development Credit (EGAT/DC) and the Ethiopia Mission responded to this lack of finance by providing a series of Micro and Small Enterprise Development (MSED) and Development Credit Authority (DCA) loan portfolio guarantees (LPGs) to the Bank of Abyssinia (BOA), a long-standing, private Ethiopian bank. USAID designed the LPGs to support BOA lending, first to agricultural cooperative unions, and then to the agriculture sector in general. The LPGs with BOA span 15 years, from the end of 1999 through 2014.

Comment

Make a general inquiry or suggest an improvement.