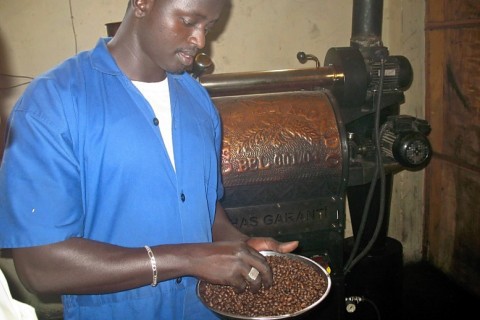

In 2003, CAFERWA, a small coffee company in the central African country of Rwanda, made a strategic decision to enter the specialty coffee market. CAFERWA recognized that selling specialty coffee on the international market would increase the company’s revenue.

To produce the improved coffee, CAFERWA needed funds to repair their coffee washing station. The only bank that was willing to extend a loan was the Rwanda Development Bank, a state-owned bank. Private banks perceived lending to agribusinesses as too risky.

To address the lack of private sector financing for agribusinesses, USAID/Rwanda designed a partial credit guarantee with Banque de Kigali using the Development Credit Authority (DCA). The DCA is a type of public-private partnership, under which USAID assumes a portion of the credit risk in order to encourage private banks to lend to creditworthy but underserved sectors. By leveraging private capital, USAID is able to have a greater and more sustainable development impact. It also addresses a knowledge gap by allowing banks to develop relationships with local borrowers.

USAID’s Agribusiness Development Activity of Rwanda (ADAR) had been helping agribusinesses, including CAFERWA, to improve both the quality and marketing of Rwandan coffee, as well as to establish business relations with buyers such as Starbucks. In 2006, ADAR referred CAFERWA to Banque de Kigali and in only one month following the loan application, CAFERWA secured a guaranteed loan from the bank to complete the renovation of the coffee station it had begun with the loan from the state-owned bank three years earlier.

The company found Banque de Kigali to be faster and more responsive than the Rwanda Development Bank. “Borrowing from Banque de Kigali is preferable to borrowing from the government because it is a private bank and thus is more business-oriented,” said CAFERWA’s Deputy Managing Director, Emmanuel Harelimana.

The loan from Banque de Kigali has enabled CAFERWA to expand its permanent staff from ten employees to thirty and become Rwanda’s third largest specialty coffee exporter. The company plans to apply for another loan from Banque de Kigali in early 2010 for a project that will further improve the value of its product. Through technical assistance, coupled with the use of DCA, USAID is having a lasting impact on Rwanda’s economy and on the lives of coffee farmers throughout the country.

Comment

Make a general inquiry or suggest an improvement.